The American Manufacturing Dream: Why Apple Can’t Easily Make iPhones in the USA

For years, there has been ongoing debate about bringing iPhone manufacturing to American soil. The idea seems straightforward enough—Apple, an American company, should produce its flagship product domestically, creating jobs and strengthening the U.S. economy. However, the reality is far more complex. At the heart of this challenge lies a fundamental issue that continues to stymie efforts to establish comprehensive iPhone production in the United States: component sourcing.

While political rhetoric often simplifies the discussion to labor costs or corporate tax rates, the true barriers to U.S.-based iPhone manufacturing run much deeper, embedded in decades of global supply chain development and specialization. This article explores the intricate challenges of component sourcing that make domestic iPhone production so difficult to achieve, despite significant political and economic pressure.

The Complex Anatomy of an iPhone

Before understanding the sourcing challenges, we must appreciate the remarkable complexity of what goes into making an iPhone.

The average iPhone contains more than 100 specialized components from dozens of suppliers spread across multiple continents. These include:

- Processors and chipsets

- Memory modules

- Display panels

- Camera modules

- Sensors and microphones

- Battery cells

- Circuit boards

- Radio frequency components

- Connectors and cables

- Various mechanical parts

Each component requires specialized manufacturing capabilities, raw materials, and expertise. The iPhone’s supply chain represents one of the most sophisticated global production networks ever created, with parts crossing international borders multiple times during production.

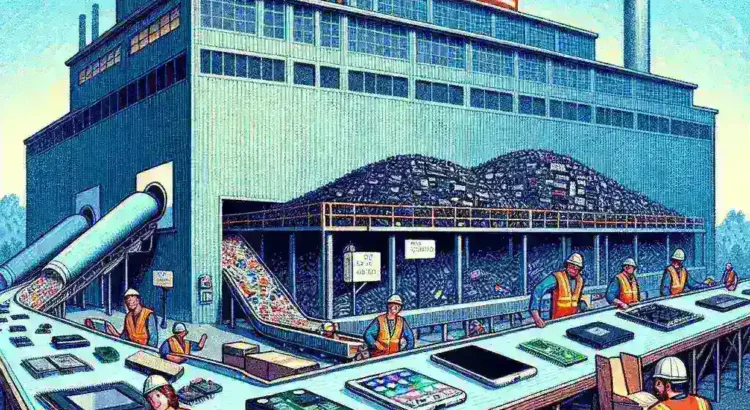

The Missing Ecosystem: Component Suppliers in America

The first and perhaps most insurmountable challenge to U.S.-based iPhone manufacturing is the absence of a robust component supplier ecosystem within American borders. Over decades, electronics manufacturing has migrated overwhelmingly to Asia, creating dense networks of specialized suppliers.

This migration wasn’t simply about lower labor costs. It represented the development of manufacturing clusters where suppliers, sub-suppliers, raw material providers, and assembly specialists could operate in close proximity, creating significant efficiencies. The density of these manufacturing ecosystems in countries like China, Taiwan, South Korea, and Japan allows for rapid iteration, problem-solving, and scale that simply doesn’t exist in the United States.

Consider the following key components that would be difficult or impossible to source domestically:

Semiconductor Manufacturing

While the United States excels in chip design through companies like Apple, Qualcomm, and NVIDIA, the actual manufacturing of cutting-edge processors has largely moved overseas. Taiwan Semiconductor Manufacturing Company (TSMC) produces Apple’s advanced A-series and M-series chips. Though TSMC is building facilities in Arizona, these represent only a fraction of their global capacity and won’t initially produce Apple’s most advanced chips.

The specialized equipment, materials, and expertise required for leading-edge semiconductor production took decades to develop in Asia and would take years to replicate in the United States, even with massive investment. The CHIPS and Science Act of 2022 aims to address this gap, but building a competitive semiconductor ecosystem will take time.

Display Technology

Modern iPhones use advanced OLED displays, primarily manufactured by Samsung Display and LG Display in South Korea, with some contribution from BOE in China. The United States has essentially no domestic production of advanced mobile displays at scale.

The specialized glass used in iPhone displays—developed by Corning, an American company—is predominantly manufactured in Asia, close to where the displays are assembled. Rebuilding this capacity in the U.S. would require billions in investment and years of development.

Battery Production

Lithium-ion battery cells for iPhones come primarily from Chinese, Japanese, and South Korean manufacturers. While the U.S. is working to develop domestic battery production, these efforts focus primarily on larger batteries for electric vehicles, not the specialized, high-density batteries required for smartphones.

The supply chains for critical battery materials like lithium, cobalt, and nickel are also predominantly based outside the United States, creating additional complications for domestic production.

The Scale Challenge: Volume and Flexibility

Another critical challenge in component sourcing relates to scale and production flexibility. Apple typically sells between 200-230 million iPhones annually. Manufacturing at this scale requires enormous production capacity for each component.

Asian suppliers have built their business models around the ability to:

- Scale rapidly: Hiring thousands of workers in short timeframes

- Adjust production: Quickly retooling for design changes

- Operate continuously: Running 24/7 production schedules

- Maintain flexibility: Responding to demand fluctuations

The iPhone’s production rhythm is highly seasonal, with massive ramp-ups before new model launches. Chinese suppliers like Foxconn can hire tens of thousands of workers within weeks—something that would be extraordinarily difficult in the U.S. labor market. This flexibility extends to component suppliers as well, who must synchronize their production with final assembly needs.

Even if individual components could be sourced domestically, the coordination challenges would be immense without the density of suppliers that exists in Asia.

The Economic Realities of Component Sourcing

Beyond the physical challenges of establishing component supply chains, there are significant economic barriers that make U.S.-based iPhone manufacturing difficult to justify from a business perspective.

Cost Implications of Domestic Sourcing

Studies have estimated that sourcing components domestically and manufacturing iPhones entirely in the United States could increase production costs by 15-30%, depending on the model. These increased costs would stem from:

- Higher labor costs throughout the supply chain

- Increased transportation expenses for components still sourced internationally

- Higher facility costs (land, construction, utilities)

- Reduced economies of scale for U.S.-only production

- Initial inefficiencies in newly established manufacturing processes

In the highly competitive smartphone market, such cost increases would either significantly reduce Apple’s margins or be passed on to consumers, potentially reducing demand. While some consumers might pay a premium for “Made in USA” iPhones, the market for devices with substantial price increases would likely be limited.

Investment Requirements and Timeframes

Building a domestic component ecosystem would require massive, coordinated investment across multiple industries. For example:

- A single advanced display manufacturing facility can cost $10+ billion

- Semiconductor fabs require similar investments, with TSMC’s Arizona facility costing approximately $12 billion for just the first phase

- Battery production facilities for smartphone-scale batteries would require billions more

- Specialized tooling, testing equipment, and precision manufacturing capabilities would need development

Even with substantial government incentives, these investments would take 5-10 years to fully implement and scale to the level required for comprehensive iPhone production. During this transition period, Apple would face higher costs and potentially less reliable component supplies than their current well-optimized global supply chain.

Technical Expertise and Specialized Manufacturing

Perhaps the most underappreciated challenge in component sourcing is the specialized technical expertise required throughout the supply chain. This isn’t simply about building factories—it’s about developing deep institutional knowledge and specialized skills.

The Knowledge Gap in Precision Manufacturing

Modern smartphones require manufacturing precision measured in microns. The specialized knowledge required for this level of precision manufacturing has developed over decades in Asian manufacturing centers and includes:

- Tooling design for miniaturized components

- Process engineering for high-yield production

- Quality control methodologies for nanoscale tolerances

- Materials science expertise for specialized alloys and composites

- Automation systems designed specifically for electronics assembly

While the United States maintains world-class expertise in certain high-tech manufacturing sectors (aerospace, medical devices, specialized electronics), the specific knowledge required for mass-market consumer electronics component production has largely migrated overseas with the manufacturing itself.

Rebuilding this knowledge base would require not just financial investment but time for workforce development, process refinement, and institutional learning—potentially a decade or more of consistent effort.

Specialized Materials and Processes

Many iPhone components require highly specialized materials and manufacturing processes that exist primarily in Asian supply chains:

- Flexible printed circuit boards (PCBs): Require specialized manufacturing techniques and materials that few U.S. companies currently produce at scale

- Camera module assembly: Involves precise alignment of multiple optical elements in dust-free environments

- Radio frequency (RF) components: Require specialized testing and manufacturing capabilities

- Rare earth elements: Critical for speakers, haptic engines, and other components, but processed predominantly in China

The specialized nature of these components means that even with significant investment, developing domestic alternatives would be challenging and time-consuming.

Apple’s Current U.S. Manufacturing Efforts

Despite these challenges, Apple has made efforts to increase U.S.-based manufacturing for certain components and products, providing insight into both the possibilities and limitations of domestic production.

Success Stories in American Manufacturing

Apple currently manufactures or sources several key components domestically:

- Mac Pro: Apple’s high-end desktop computer is assembled in Austin, Texas

- Certain glass components: Developed with Corning in Kentucky

- Some specialized chips: Manufactured by U.S.-based facilities

- Select machined parts: Produced by precision manufacturers in various U.S. locations

These examples demonstrate that high-value, lower-volume production can work in the United States. However, they also highlight the selective nature of what can currently be produced domestically—typically components that are either less scale-sensitive or command premium prices that can absorb higher production costs.

Lessons from Partial Manufacturing Efforts

Apple’s experience with U.S. manufacturing provides several insights:

- Component proximity matters: The Mac Pro can be assembled in Texas because many of its components are still imported, with final assembly happening domestically

- Premium products have more flexibility: The Mac Pro’s high price point provides margin to absorb some increased domestic production costs

- Scale limitations remain significant: The Mac Pro is produced in much lower volumes than iPhones, making domestic assembly more feasible

These lessons suggest that while selective domestic production is possible, the comprehensive reshoring of iPhone manufacturing faces much greater challenges due to volume requirements and the complexity of the component supply chain.

Potential Pathways Forward

While full iPhone manufacturing in the United States remains challenging, there are potential pathways toward increasing domestic production over time.

Incremental Approach to Component Sourcing

Rather than attempting to relocate the entire iPhone supply chain at once, a more realistic approach involves gradually increasing the percentage of domestically sourced components:

- Target high-value components first: Focus on semiconductors, advanced materials, and specialized parts where the U.S. has existing expertise

- Develop regional manufacturing hubs: Create concentrated areas of expertise to build supplier ecosystems

- Leverage existing strengths: Build on areas where U.S. manufacturing already excels, such as advanced materials, precision machining, and specialized electronics

This approach would allow for the gradual development of domestic capabilities while maintaining the reliability and efficiency of the existing supply chain during the transition.

Public-Private Partnerships and Investment

Addressing the component sourcing challenge will likely require collaboration between government, industry, and educational institutions:

- Targeted incentives: Tax benefits, grants, and subsidies focused specifically on component manufacturing capabilities

- Workforce development: Specialized training programs for advanced manufacturing skills

- Research and development funding: Support for developing next-generation manufacturing technologies

- Supply chain resilience initiatives: Programs specifically designed to reduce dependence on single-source components

The CHIPS and Science Act represents a step in this direction for semiconductors, but similar initiatives would be needed across multiple component categories to enable comprehensive iPhone manufacturing.

Hybrid Manufacturing Models

In the near to medium term, the most realistic approach may involve hybrid models that combine domestic and international manufacturing:

- Final assembly and certain components in the U.S.: Focusing domestic efforts on areas where U.S. manufacturing is most competitive

- Phased transition for other components: Gradually moving additional component production as domestic capabilities develop

- Specialized product lines: Creating U.S.-manufactured variants for specific markets or applications

This approach would allow for meaningful progress toward increased domestic manufacturing while acknowledging the current realities of the global supply chain.

The Future of iPhone Component Sourcing

Looking ahead, several factors could influence the feasibility of U.S.-based iPhone component sourcing and manufacturing.

Technological Developments

Emerging technologies could potentially change the economics and feasibility of domestic production:

- Advanced automation and robotics: Reducing the labor cost differential between regions

- Additive manufacturing (3D printing): Enabling more flexible, localized production of certain components

- New materials science: Creating opportunities for the U.S. to lead in next-generation components

- Artificial intelligence in manufacturing: Optimizing production processes and reducing the expertise barrier

These technologies could potentially reduce some of the barriers to domestic component production, though the timeline for their impact remains uncertain.

Geopolitical and Supply Chain Considerations

External factors are already influencing supply chain decisions:

- Growing emphasis on supply chain resilience: The COVID-19 pandemic and other disruptions have highlighted the risks of concentrated supply chains

- Increasing geopolitical tensions: U.S.-China relations and other international factors are prompting reconsideration of supply chain dependencies

- Changing consumer preferences: Growing interest in product origin and sustainable manufacturing practices

These factors may accelerate efforts to develop more diverse component sourcing options, potentially benefiting domestic manufacturing initiatives.

Conclusion: The Complex Reality of iPhone Manufacturing

The challenges in sourcing components for U.S.-based iPhone manufacturing represent a complex interplay of economic, technical, and historical factors. While the desire to see iPhones manufactured domestically is understandable, the reality is that decades of global supply chain development have created a situation where complete reshoring is extraordinarily difficult.

The missing component ecosystem in the United States represents not just absent factories, but absent knowledge, experience, scale, and supplier networks that would take years or even decades to fully develop—even with massive investment. This doesn’t mean progress is impossible, but it does suggest that expectations should be realistic about the timeframes and approaches required.

Most likely, the path forward will involve selective domestic manufacturing of certain components, gradual expansion of U.S. capabilities in strategic areas, and continued reliance on global supply chains for many specialized parts. This hybrid approach represents the most practical balance between the ideal of domestic manufacturing and the realities of today’s complex global electronics ecosystem.

The iPhone, perhaps more than any other product, embodies the globalized nature of modern manufacturing. Its components and assembly represent the culmination of specialized expertise developed across multiple countries and continents. Changing this reality will require not just political will or corporate decision-making, but a fundamental transformation of manufacturing capabilities and component ecosystems that will inevitably take time.

As consumers, policymakers, and industry leaders consider the future of electronics manufacturing in the United States, understanding these component sourcing challenges is essential for developing realistic strategies that can gradually increase domestic production while maintaining the innovation, quality, and value that consumers expect from products like the iPhone.